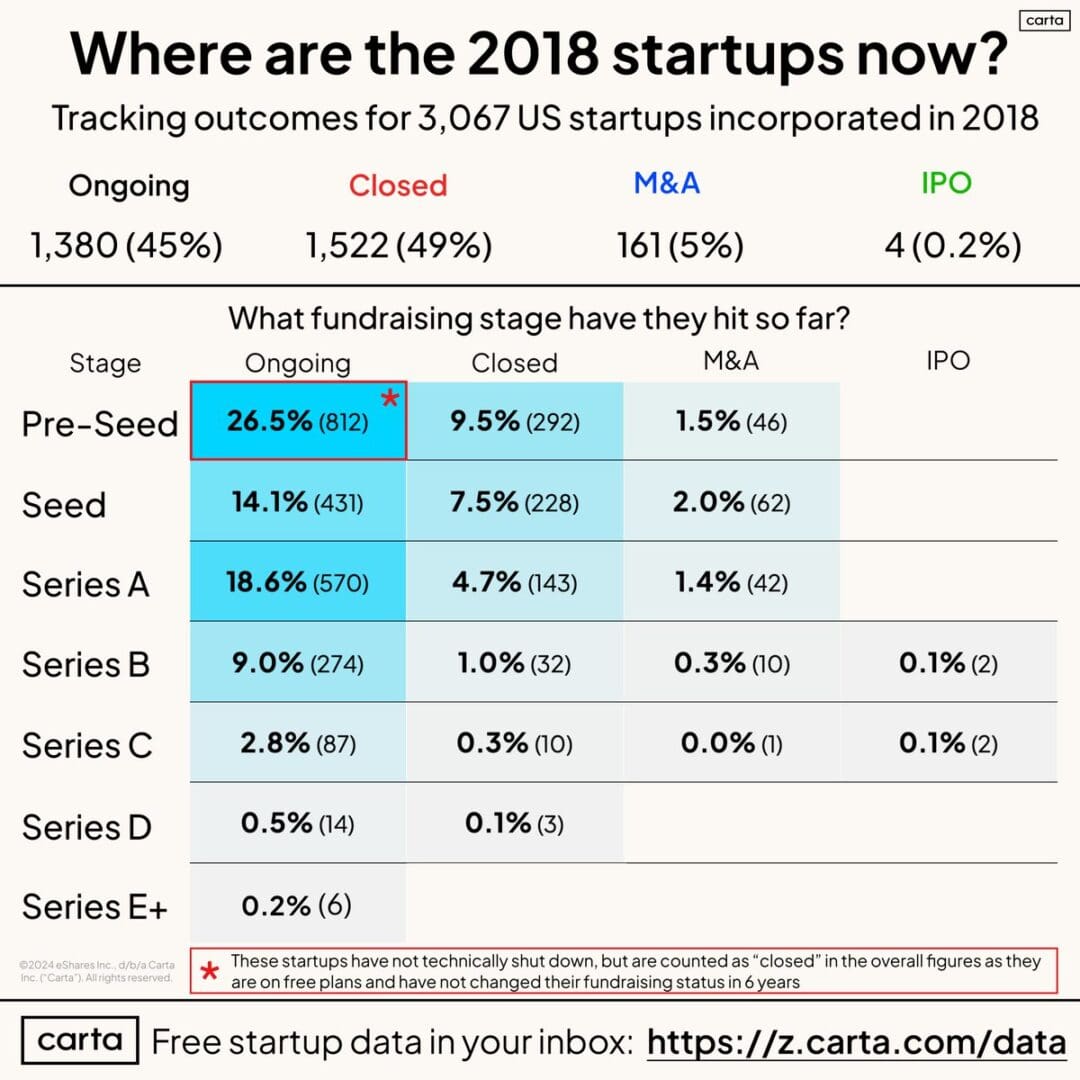

Carta recently released some data that I found to be very informative regarding the outcomes of startups in the first 5 years after being founded (from 2018 to early 2024):

It is noted that very few startups went public in the first 5 years, which is understandable as it typically takes at least 8-10 years to IPO nowadays. Approximately half of the Seed stage startups had ceased operations by Year 5, which aligns with expectations.

When it comes to acquisitions, the data shows that about 5% of startups on Carta were acquired within the first 5 years. However, it’s unclear how many of these acquisitions were acqui-hires or for a small amount. It is estimated that at least two thirds of these acquisitions were modest, with only 1/3 resulting in an exit that yielded 3x-10x the last funding round price.

Based on this data, it can be reasonably inferred that 1%-1.5% of startups achieve a “good” exit within the first 5 years.

While this may seem challenging, it emphasizes the importance of playing the long game in startup success. Many successful exits do not happen within the first 5 years, and perseverance is key. Building real value in the business may take years 6-10+ in the SaaS and B2B industries.

For further insights, check out a related post here.